A gift annuity might be something you want to consider. Plus, if you are looking for the right tools to either create income or get a tax deduction at the same time, you will still need to look at a charitable annuity. That is how it happens; you make a gift to an organization, and in turn, they give you an income stream for life – such a creative way to give – what could be better?

Link Charity is one of the best companies in Canada when it comes to making a charitable gift annuity becuasue they allow you to give to countless charities of your liking.

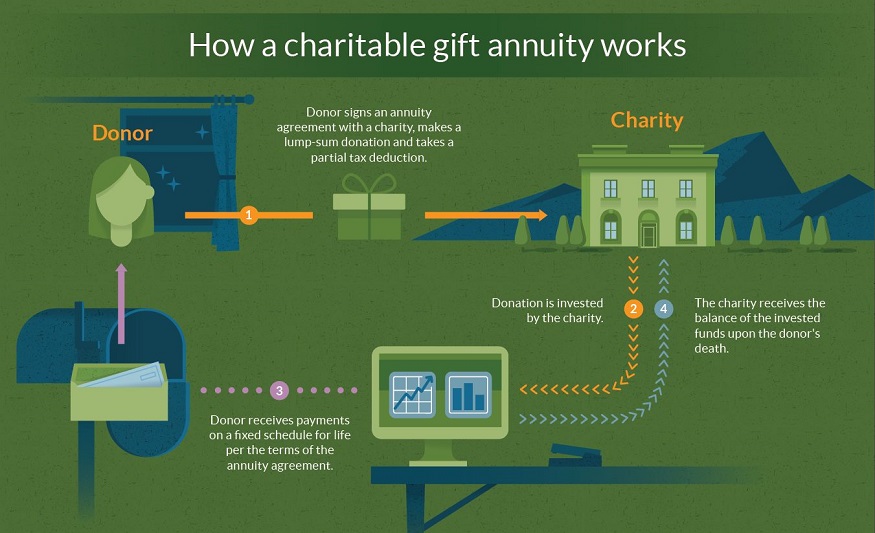

How does it work? Let’s get a glimpse.

How It Works

Ifyou donate a capital sum of money;

- Your gift is invested in an investment pool and will, in turn, generate a return of around 8% on average.

- You get a tax-free, guaranteed annual lifetime income (5%-10%) of the initial gift based on your age.

- You immediately get a charitable tax receipt, which makes up to between 20%-25% of your initial income.

What Happens at Death?

Since you chose to live a legacy by giving to charity, at death, the remaining capital you invested is distributed to the charities you want(and they will get an immense benefit).

Benefits of charitable gift annuities

Charitable gift annuities are a powerful charitable planning vehicle that is handy in avoiding probate fees.

Read more: Bharat Bhise – How Do Private Equity Companies Make Their Money

By making gifts to charities, you will;

- Receive a source of regular payments for life

- Get an opportunity to defer the capital tax gains when purchased with appreciated securities, and

- Get an immediate tax deduction

When a Charitable Gift Annuity Makes Sense: Who Benefits?

This planned giving tool isn’t for everyone.But, it is an ideal solution if you;

- Qualify to be in a high tax bracket

- Are over age 70

- Want a dependable income stream for life

- Don’t want to watch interest rates, investments, maturity dates and so on

Types of Charitable Gift Annuities You Need to Know

- Immediate gift annuity: This is where your payment starts immediately. The payments can be made quarterly, monthly, semi-annually, or monthly.

- Deferred gift annuity: You can receive payments at a later date, depending on the dates you choose. You only receive these payments after more than a year of the initial contribution.

- Flexible gift annuity: Here, you don’t choose a designated date to start receiving your payments. This option is therefore for the future, say when you retire. The older you are, the larger the payments will be.

That brings us to the three payment options for charitable gift annuities you might want to consider depending on your situation. They include;

- Single life: Paid to only one person for life

- Two lives in succession: Payment is made to one annuitant and then to a second – if he or she outlives the initial annuitant

- Joint and survivor: This is where two people get simultaneously paid until one dies – it is only then when the survivor receives payment from the combined amount.

The Bottom Line

If you make a significant contribution to a charity you care about, it’s a win-win for you and for charity.Contact Link Charity today to find out if a charitable gift annuity could work for you and don’t forget to like us on Facebook, Linkedinand Twitter.