Do you have other expenditures on your bucket list that you would love to buy as soon as you have funds or does your home need some experts for repair, then how long will you have to wait? Sometimes we may not have emergencies but we don’t want to waste time because we would like to see our projects into reality. However, when we lack funds whatever projects we have in mind cannot be achieved so we might have to borrow money from family and friends or find a lending company.

Click the link at lånutensikkerhet.org/ if you wish you take out funds through unsecured loans because this might be the solution to your worries right now and this will help you find financial resources. Keep in mind that plans of borrowing do not mean to grab the first opportunity or lender you can see from the ads because all those are purely promotions. We can never tell which one of those lending firms can provide us cash with the most favorable offer and the ideal type of loan for our finances.

Let’s assume that you are determined to send a formal loan application but you should only do this after deciding the type of unsecured debt because options are very important. Now if you have not planned yet, then it is better to learn more about these choices so that you won’t regret making wrong decisions. Keep in mind that loaning is associated with costs so don’t just apply without checking affordable offers and be smart since you’ll be repaying the debt.

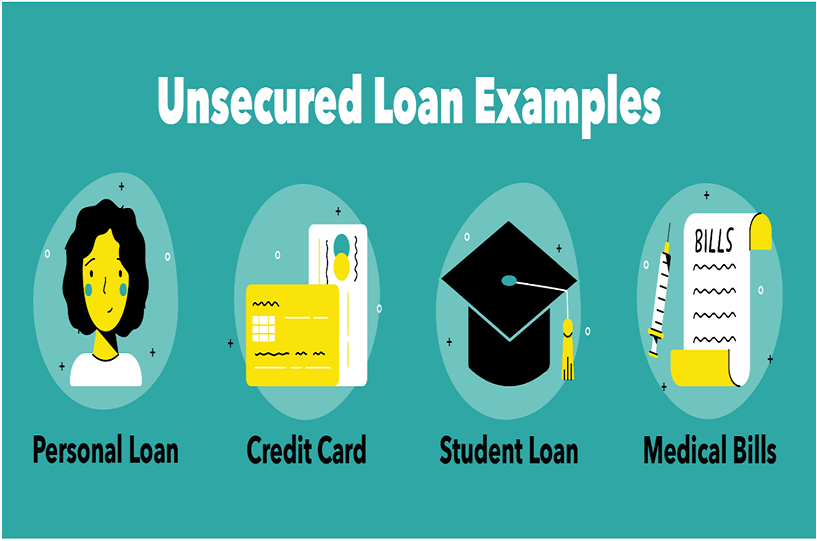

Unsecured Debts

As you already know, you do not need assets here for your collateral because it is unsecured so this means that you can keep your properties safe and under your control unlike when applying for secured loans. I guess that is one good advantage because you don’t have to prepare a lot of documents when applying but make sure that you will be approved for the amount you are requesting by having a good credit score. Let me remind you that this rating is very important when it comes to unsecured debts because this is the only basis for granting most requests from valued clients.

Due to a few documents required, the borrowers feel less burden and effort when filing a formal application. They may even send this online because most lending companies today are also offering their services through their official websites or applications that you may just install on your smartphone.So if it is that lax and convenient to many consumers, then who would not be encouraged to take out loans?

Indeed these funds will be helpful to consumers but again, make sure that you are going to repay them on time so you won’t be charged with additional fees. And then, be very sure to settle your outstanding balances before the grace period because this will leave a negative mark on your credit rating. When that happens, you may not have the chance to borrow money from various lenders and you have to wait for years before you can start loaning again so you can’t rely on them for emergencies except for those who offers non-credit checking services.

Credit Card Debt

You can only be a cardholder if you have a stable salary and job because the credit card companies would like to make sure that you can repay your purchases as well as advances. A lot of individuals are now using credit cards because of cashless transactions, especially during the pandemic where many of us make purchases online and that is because we have to minimize going outdoors to avoid contamination. Even now that the situation in different countries is getting better since we are now vaccinated, we continue using our credit cards and enjoying the perks of this.

What’s great about owning these cards is that we use this in paying bills and it is even more convenient to carry them wherever we go. However, there is a limit to the usage so we cannot overspend. Just make sure that you are going to pay what you consumed on the specified due date to avoid extra charges.

Student Loans

Education is very important so we will do everything to enter a university and finish a degree. In this way, we can land better jobs or get a high-salary position. Anyway, it is not that bad to make a dream and have a career that we are wishing for so why not take a student loan to assist you with your studies if this kind of service is available?

Some organizations are offering scholarship programs to qualified students and if there is a chance, I suggest you consider this as well. But if you did not make it and still want to study, then let’s stick to the funds from lending companies.

With this debt, you do not need to repay it while you are studying. The lenders will support your finances and will let you graduate. After that, you have to find a job so that you can start repaying them. Some of them may even help you get a job so try to check on other services aside from financial support.

Medical Debt

We are just human beings so we may get ill no matter how much we try to keep our bodies healthy and pretty sure that no one in this world would preferto get sick. Sometimes, those who are financially struggling are the ones who are also experiencing various medical conditions and these are things that we cannot ignore. You will do everything to find money just to buy medicines, pay hospital bills as well as the experts.

When it comes to such situations and our loved one’s health is a concern, we even try to ask for medical assistance from various foundations and government offices. But we may also apply for medical loans, which are often offered in the hospitals, clinics, and some lending companies, too. Once granted your request, they will give you vouchers or discounts and pay bills in installments.

Signature Loans

Use this fund for any purpose you can think of. This is a personal debt and nobody will ask you where this money is intended for. You may send your applications to banks, credit unions, and private lenders for funding requests.

When you have a good credit rating, you’ll have a chance of getting lower interest rates. But make sure to ask for the requirements which vary and depend on the lending company. I supposed credit scores will be needed so you should have prepared for this when you know that you will someday need to take out such debts.