Trading commodities is a fascinating world of opportunity and risk, where traders can profit from the price movements of essential goods such as gold, oil, and agricultural products. However, to navigate this market successfully, one must understand the concepts of leverage and margin. In this blog, we will delve into what leverage and margin are, their significance in commodity trading online, effective risk management strategies, the variations in different commodity markets, and how to embark on commodity trading in SA via a commodity trading platform.

What is Leverage

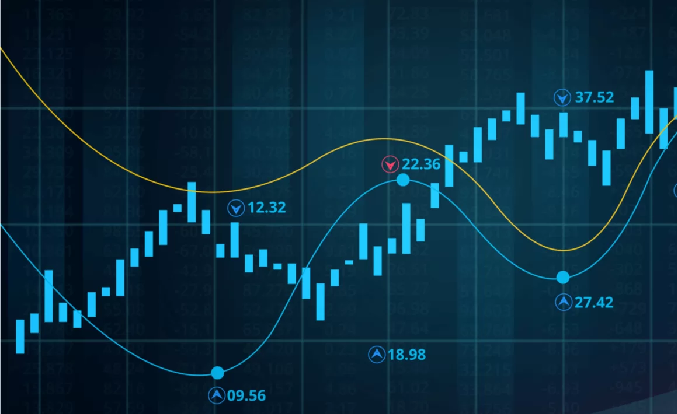

Leverage is a double-edged sword that can amplify profits and losses in trading commodities. It is a borrowed capital that allows traders to control a more substantial position size than their initial investment. In other words, it magnifies your market exposure. For instance, if you have $1,000 and use 10x leverage, you can trade as if you had $10,000.

While leverage can potentially result in significant gains, it also exposes traders to higher risk. If the market moves against your position, losses can accrue rapidly. Therefore, understanding the amount of leverage you are using and its implications is crucial. Risk management strategies, like setting stop-loss orders and position sizing, become vital when trading with leverage.

What is Margin

Margin is the collateral you must provide to open and maintain a leveraged position. It acts as a form of security for your broker. When you open a position with leverage, a portion of your account balance is set aside as margin. The required margin amount varies based on the leverage and the commodity traded.

For example, if you want to control a $10,000 position with 10x leverage, you might need to deposit $1,000 as a margin. If your losses exceed the margin amount, you may receive a margin call, requiring you to deposit additional funds or close your position to cover the losses.

Importance of Leverage and Margin in Commodity Trading Online

Online commodity trading has become increasingly accessible thanks to the proliferation of trading platforms. Leverage and margin are critical components of this accessibility. They enable traders with limited capital to participate in commodity markets that would otherwise be out of reach.

However, with great power comes great responsibility. Traders must be aware of the risks associated with leverage and margin. It’s easy to be lured by the potential for substantial profits, but without proper risk management, losses can quickly accumulate. Therefore, it’s essential to use leverage and margin judiciously, ensuring they align with your risk tolerance and trading strategy.

Effective Risk Management Strategies

In trading commodities, risk management is the key to long-term success. Here are a few strategies to help you manage risk effectively:

- Stop-Loss Orders: Set predefined stop-loss levels to limit potential trade losses. This ensures that you automatically exit a position if the market moves against you beyond a certain point.

- Diversification: It is advisable to refrain from investing all your capital in one commodity. Diversifying your portfolio across various commodities can help spread risk.

- Risk-Reward Ratio: Before making a trade, calculate potential risk and reward to ensure that the reward justifies the risk.

- Position Sizing: Determine the appropriate position size based on your risk tolerance and account balance, and avoid exceeding your affordable loss limit.

Leverage and Margin in Different Commodity Markets

Commodity markets can vary significantly, and leverage and margin can differ from one market to another. For example, precious metals like gold and silver often have lower margin requirements than energy commodities like oil. Understanding these differences is crucial when crafting your trading strategy.

It’s essential to research and familiarise yourself with the specific margin requirements and trading conditions of the commodity markets you wish to participate in. Some calls may be more volatile than others, requiring a different approach to risk management.

Embarking on Trading in SA via a Commodity Trading Platform

For South Africans venturing into trading commodities, the first crucial step is selecting a dependable and regulated commodity trading platform that grants access to desired markets and commodities. To embark on this journey effectively, aspiring traders should first educate themselves about the commodities they wish to trade and grasp the fundamentals of trading. Secondly, opt for a regulated online trading brokerage platform like Banxso to ensure a secure trading environment. It’s advisable to practice using a demo account, commonly offered by most platforms, to gain experience without risking natural capital. Developing a comprehensive trading plan, including risk management strategies and clear trading goals, is essential. Lastly, it’s wise to start with a small account and progressively increase trading size as you accumulate experience and confidence in the market.